CEO GREETING

To the shareholders of Sunjin Beauty Science Co., Ltd,

I am Sungho Lee, CEO of Sunjin Beauty Science. This is our third shareholders’ meeting since Sunjin Beauty Science was listed on the KOSDAQ in January 2021.

In 2023, we published a shareholder letter for the first time and posted it on our company website. We received positive responses from many people, including current shareholders, potential investors, job seekers, and industry partners. As such, we are pleased to present another shareholder letter for the 2024 shareholders’ meeting.

Brief summary of our performance in 2023

Sunjin Beauty Science achieved another record-breaking year in 2023 with strong revenue and profit growth.

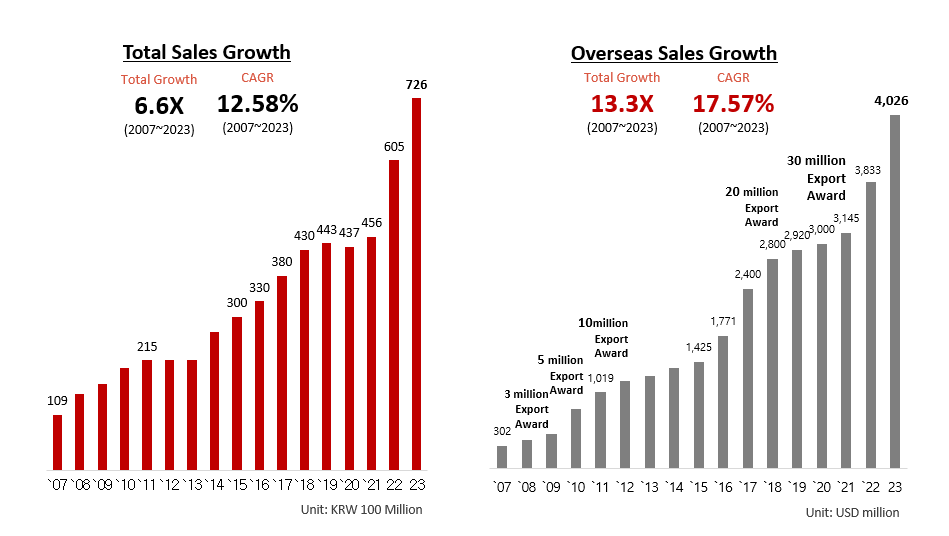

In 2023, we achieved 72.6 billion won in sales, a 13% increase (82.9 billion won) compared to the previous year and recorded 9 billion won in operating profit, a 69% increase (3.7 billion won) compared to the previous year.

In fact, with a 32% increase in revenue compared to 2021, reaching 643 billion won in 2022, there was a significant growth. However, there were some concerns about the performance in 2023 as it’s often the case that when revenue grows too much in the previous year, the following year’s performance may suffer. However, fortunately, we were able to overcome this and demonstrate that we entered a solid growth trajectory.

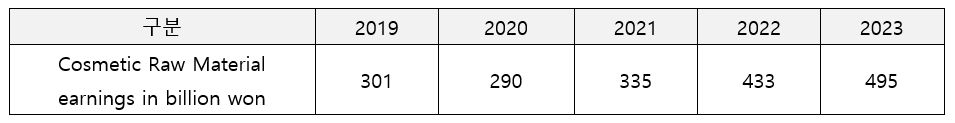

Increase in operating profit due to the growth of high-value-added cosmetic raw material

Cosmetic raw materials, SUNJIN’s main

business, grew by 10 billion won and by 28% compared to the previous year. In

particular, sales growth in EU region is remarkable. SUNJIN achieved 66% growth

to 17.7 billion won from 10.6 billion won in the previous year.

Firstly, sales of high-value-added cosmetic materials have been consistently increasing.

Cosmetic raw materials, SUNJIN’s main

business, grew by 10 billion won and by 28% compared to the previous year. In

particular, sales growth in EU region is remarkable. SUNJIN achieved 66% growth

to 17.7 billion won from 10.6 billion won in the previous year.

Secondly, there is a leverage effect on operating profit due to increased manufacturing productivity.

The production capacity expansion at the Janghang factory, which commenced operations in 2019, has led to increased productivity and direct manufacturing cost savings. Following the existing F1 and F2 factory, the addition of the F3 in 2023 and the opening of a new research site in January 2024 have further contributed to this trend.

Leveraging the accumulation of production activities inherent in manufacturing, including 1) experience curve effects, 2) economies of scale resulting from increased production volume, and 3) continuous automation, we anticipate a significant acceleration in growth of operating profit with the projected increase in cosmetic material sales (production volume) in the future.

As evidenced by our 2023 revenue and operating performance, we expect a clear correlation between revenue growth and subsequent increases in operating profit, reflecting the company’s ability to capitalize on future revenue growth for enhanced profitability.

Here are our plans for the further growth of company in 2024:

First, strengthen the development of innovative cosmetic raw materials.

In 2022, SUNJIN achieved great growth in the cosmetics raw material business and made a foray into the cosmetics ODM business newly.

This is one of the rare cases in the world. SUNJIN differentiates the business from general ODM business. 1) specializes in OTC ODM based on the US FDA utilizing the strengths of a US FDA-certified cosmetic raw material manufacturer, 2) incorporates differentiated materials directly into the various formulations, and 3) introduces the business to global cosmetic raw material customers and uses it for raw material promotion as well.

SUNJIN expects to be able to create new revenue sources through it and will have differentiated competitiveness in the cosmetics ODM business.

Second, intensifying sales activities

In 2023, Sunjin Beauty Science kept strengthening online and offline sales activities. Notably, we consistently sent newsletters to 47,043 subscribers worldwide as an online sales activity and participated in various domestic and international exhibitions for offline activity.

Third, ODM Business in earnest

Considering the high potential of the cosmetic ODM business we ventured into in 2023, we are planning to establish a new ODM factory in 2024. Despite the modest revenue from our overseas clients and projects in 2023, we believe in the positive outlook and the interest shown by customers, prompting us to invest proactively.

With the expected expansion of the domestic ODM/OEM market due to the increasing preference for indie brands and the global popularity of K-beauty, we aim to leverage the advantages of our Janghang factory, which obtained FDA API manufacturing certification in 2019, to create synergies with our existing cosmetic material business.

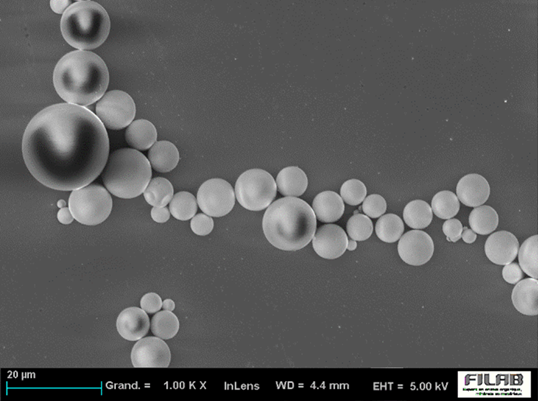

Lastly, entering the field of bio-cosmetics business

Sunjin Beauty Science plans to launch bio-cosmetic materials in the first half of this year, utilizing synthetic bioengineering technology. Recognizing consumers’ preference for vegan ingredients in cosmetics, we aim to embark on a visionary journey by replacing animal-derived ingredients with plant-based ones using synthetic bioengineering technology.

Concluding Remark

Sunjin Beauty Science is a company on the path of growth. Securities reports covering our company were issued five times in 2023. Recalling that there were five reports issued in 2022 also, Sunjin Beauty Science got remarkable attention from the securities industry towards our company’s scale.

As we gather for this year’s shareholders’ meeting, we express our gratitude once again to our shareholders for their trust and insight into our company. We remain committed to striving harder to repay the interest and support of our shareholders in the future.

March 29, 2024

Sunjin Beauty Science 36th Regular Shareholder’s meeting

Sungho Lee

© Copyright - Sunjin Beauty Science